Could soda be a health-conscious choice? This is the question that ultimately led to the founding of OLIPOP, a pioneering beverage company that surpassed $400 million in sales in 2024. Co-founders Ben Goodwin and David Lester envisioned a carbonated drink that preserved the nostalgic appeal of traditional sodas while incorporating prebiotics and plant-based ingredients to promote gut health.

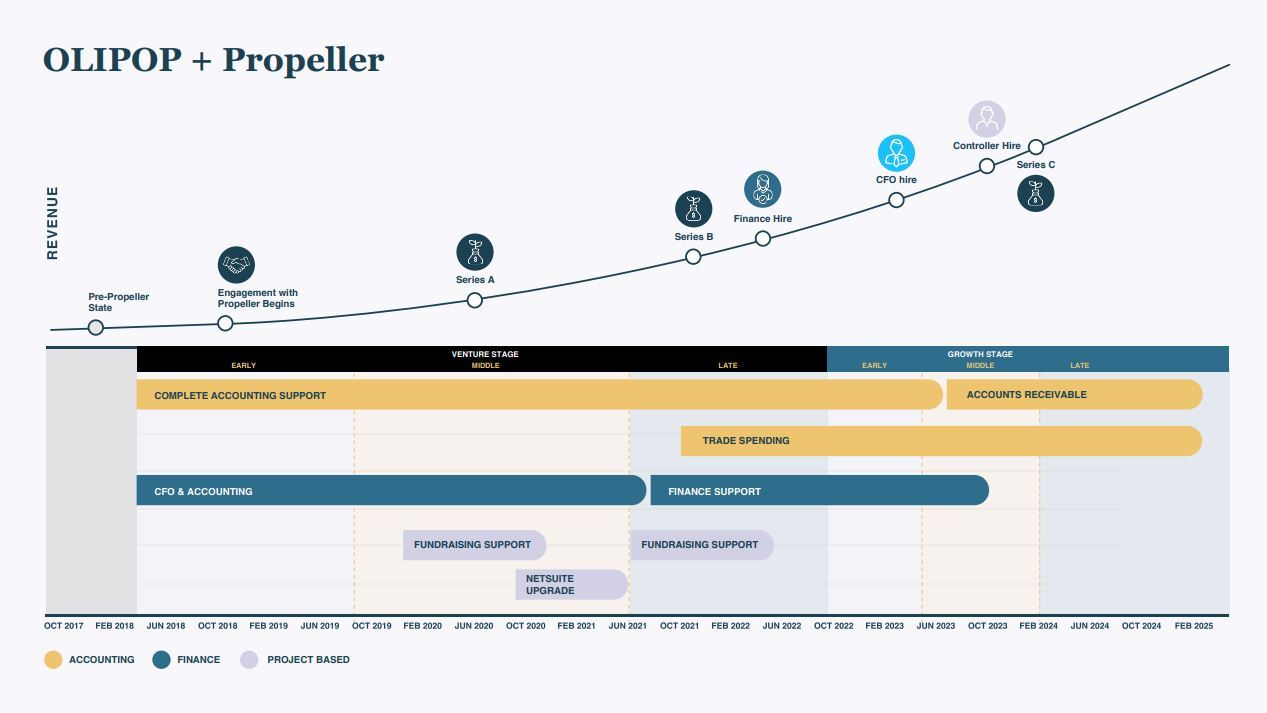

Scaling from $1M a year to $1M a day, however, requires more than just product innovation. Rapid expansion could have easily overwhelmed OLIPOP’s financial infrastructure, leading to cash flow constraints, supply chain disruptions, and inefficient capital deployment. To ensure sustainable, scalable growth, OLIPOP turned to Propeller Industries.

Creating a tasty, gut-friendly soda was no small task. The real kicker? Scaling it in a cutthroat market where big brands had been calling the shots for decades. OLIPOP needed to prove that a healthier alternative could not only compete but also dominate. The question remained: How do you scale a capital-intensive business in a fiercely competitive market without melting your financial systems?

The answer: One step at a time. Balance cost efficiency with scalability. Leverage experience to build only what’s necessary—robust enough to support growth without being overly complex. Have confidence that your systems will scale, but maintain the flexibility to iterate constantly. Focus on the 80/20 rule—optimizing what matters most while staying agile for what comes next.

OLIPOP partnered with Propeller to build flexible financial infrastructure that balanced affordability with risk mitigation while delivering the flexibility to enable rapid, capital-efficient expansion.

With a 17-year track record of success guiding 1,100+ high-growth startups, Propeller brought OLIPOP a battle-tested financial playbook engineered to turn early-stage challenges into scalable success. Anchored in great talent, data-driven decision-making, and operational discipline, Propeller’s tried and true system established a future-ready financial foundation for the brand.

Before the brand could effectively scale, it needed a financial backbone as forward-thinking as its product. By 2018, Propeller had successfully supported Krave Jerky, Sir Kensington’s, and Chameleon Cold Brew from early stage through 9-figure acquisitions by Hershey, Unilever, and Nestle. Propeller was able to leverage a proven team, process and systems to build out critical areas:

This wasn’t just about building a model or managing the books—it was about creating a dynamic blueprint for growth and building confidence in Propeller’s ability to support OLIPOP’s financial decision-making for years to come.

As revenue surged from $1M per month to $1M per week, the stakes grew higher. OLIPOP’s needs increased dramatically, along with their financial resources and the expectations of founders and shareholders for next-level financial support. Propeller was well-positioned to navigate a broad range of scalability challenges, providing:

Propeller was able to seamlessly adapt to OLIPOP’s changing needs through a period of massive transformation – delivering peace-of-mind, thought-partnership, and consistent operational execution across an extremely broad range of challenges.

In 2022, OLIPOP reached several major milestones—$50M in both revenue and capital raised, along with the hiring of its first CFO. With the talent and resources to assume full control of its finance leadership, the company was entering a new phase of growth. Propeller once again demonstrated the breadth and depth of its capabilities by evolving its role to meet OLIPOP’s changing needs:

As OLIPOP scales through $400M in revenue and a recent $1.85B valuation, Propeller’s growth-stage teams provide assurance that OLIPOP always has access to a deep bench with the right people for the right roles at the right cost.

Unlike many beverage startups that expand prematurely, OLIPOP focused on revenue quality over quantity. The company delayed entry into Amazon and convenience store distribution until existing channels were meeting performance expectations.

As OLIPOP’s growth surged, their people, processes, and systems faced constant strain. Propeller’s support evolved alongside them, ensuring they remained agile through each growth phase.

Propeller’s data insights from working with hundreds of CPG companies provided OLIPOP with an unfair advantage. Propeller was more than a service provider—they became a trusted partner.

OLIPOP approached Propeller’s partnership as an investment, not an expense. Propeller’s proven systems and expertise delivered scalable, flexible growth without overextending resources.

OLIPOP’s meteoric rise underscores the transformative power of strategic financial planning. By partnering with Propeller, the brand navigated the complexities of hypergrowth with a structured, scalable financial foundation.

Let’s start a conversation today.

Propeller Industries is not licensed by the state of California and the accounting services being offered do not require a state license.

Sign Up for Our Newsletter