In the last 12 months, the beverage industry witnessed an extraordinary phenomenon: five startups achieved coveted unicorn status. OLIPOP, poppi, Liquid Death, Alani Nu, and Ghost Energy each surpassed the billion-dollar valuation mark — a remarkable feat in an industry where shelf space is limited and competition is fierce. OLIPOP’s recent Series C funding pushed its valuation to $1.85 billion; Poppi and PepsiCo just announced the startup’s acquisition for $1.95 billion; and Liquid Death achieved a $1.4 billion valuation late last year.

Most CPG startups never break $10 million in revenue, so to reach unicorn status? That’s like being struck by lightning three times. Even more striking is that three of these companies (OLIPOP, poppi, and Liquid Death) are in Propeller’s client/alumni portfolio. Apparently, 60% of beverage unicorns prefer Propeller.

Though all three compete in the same beverage / CPG industry, their paths to success are a little different. OLIPOP created a scientifically formulated prebiotic soda. poppi rebranded a similar concept with trendy packaging and a punchy message. Liquid Death put water in beer cans with death metal branding. Different approaches, same billion-dollar result.

So what’s the secret sauce they all have in common? After working alongside these three unicorns from their early days through their meteoric rises, Propeller Industries has identified the key patterns that separate these billion-dollar CPG companies from the rest.

The Market Timing Imperative: Why “Good Enough” Isn’t

The entrepreneurial journey is paved with hard-earned insights, and Ben Goodwin’s path to building OLIPOP is a compelling case study in strategic market entry. Before his prebiotic soda company reached billion-dollar status, Goodwin navigated the painful reality that even impeccable execution can’t overcome fundamental market limitations. His earlier functional beverage brand faltered despite strong operational performance, a powerful reminder that market readiness trumps execution when building category-defining companies.

OLIPOP‘s breakthrough came through perfect market synchronicity: launching precisely when consumer sentiment was shifting away from traditional sodas, while simultaneously embracing gut health benefits. This alignment created ideal conditions for disruption in the “healthy soda” category.

Meanwhile, poppi deputed its post-Sharktank rebrand just after the COVID lockdowns, when consumers were stuck at home and looking for novelty (and a healthy drink). And poppi founder Allison Ellsworth found herself posting highly personal TikTok videos about her product just as influencer-marketing was going viral, netting her millions of views and emptying store shelves.

The Timing Roadmap:

- Identify the emerging wave. OLIPOP and poppi recognized that Americans were still consuming massive amounts of soda while becoming increasingly health-conscious. This contradiction created tension in the market and opened up opportunities.

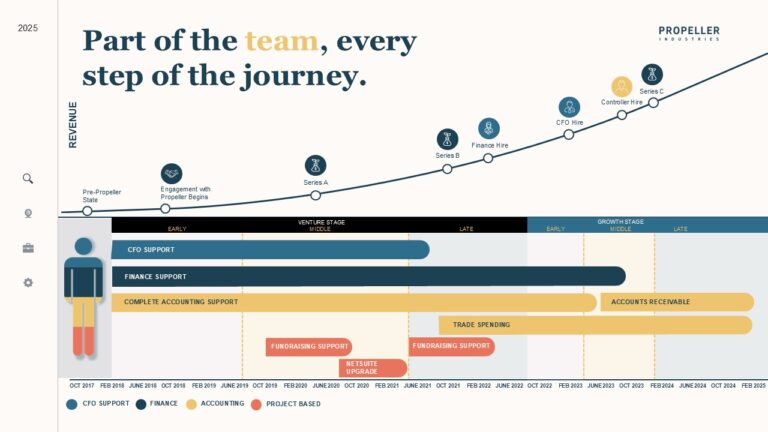

- Find the tipping point. When you’re plotting your company trajectory on our growth chart, there’s a crucial moment where consumer awareness meets market readiness. For these beverage unicorns, this typically happened around Series A.

- Gather market evidence. Liquid Death entered when Gen Z was drinking less alcohol and plastic bottles were increasingly viewed as environmentally problematic. They didn’t just guess at these trends; they validated them.

- Match your financial strategy to your market timing. As our growth chart shows, these companies built their finance function to match their trajectory, moving from cash basis to accrual accounting as they scaled.

Competition as Catalyst: Why Rivals Actually Accelerate Your Growth

What’s particularly fascinating about the prebiotic soda market is how competitive dynamics defied conventional wisdom. When poppi emerged with a similar concept to OLIPOP, industry experts predicted a zero-sum battle. Instead, the two brands created what became known as the “wall of prebiotic soda effect”— collectively validating the category through shared shelf presence. This visual reinforcement builds consumer confidence without requiring prior category knowledge. Bloomberg Intelligence recently found that OLIPOP and poppi comprise 2.7% of the $44 billion US carbonated beverage market, double the market share they held just a year ago.

The Competition Advantage Framework:

- Embrace category creation. The first successful mover in a category (like OLIPOP) creates the space, but subsequent entrants (like poppi) validate and expand it.

- Strategically differentiate. Notice how in our growth chart, when companies reach the “middle venture stage,” they begin implementing more sophisticated financial systems like audit-ready financials and trade spending tracking. This same pattern applies to product differentiation.

- Monitor shelf density. There’s a sweet spot of category representation that signals importance to consumers without overwhelming them with choices.

- Consider co-marketing opportunities. Some of these unicorns found ways to indirectly leverage each other’s momentum without explicit partnerships.

Mike Cessario, Liquid Death’s founder, took this concept further by creating a product so visually distinct that it couldn’t be ignored, even in a crowded water market. If your product is just water, and you turn that into a billion-dollar business, that tells you everything you need to know about the brand.

Brand as Business: How Identity Drives Enterprise Value

The Ellsworths’ rebranding from “Mother Beverage” to “poppi” demonstrates how pivotal brand identity can be in consumer packaged goods. Their trajectory highlights a fundamental truth: in CPG, brand essentially equals value. Even with perfect formulation, pricing, and visionary leadership, products falter without resonant branding. Liquid Death exemplifies this principle through deliberately provocative campaigns like “Kegs for Pregs” that generate authentic demand through boundary-pushing creativity. “We’re not a marketing agency,” Propeller Founder, Chris Fenster, says, “but every CFO needs to understand the interdependence between brand and enterprise value.”

The Brand Value Matrix:

- Identify your brand’s emotional core. OLIPOP connects with nostalgia for classic sodas but with a scientific health twist. Liquid Death taps into rebellion and irreverence.

- Express identity through every touchpoint. As our growth chart shows, by the time these companies reached Series B, they had implemented comprehensive financial systems. Similarly, their branding became fully integrated across all channels.

- Make tactical brand investments. During the “middle venture stage,” these companies strategically increased their trade spending (as shown in our chart) to support brand awareness.

- Measure brand impact on valuation. The connection between brand perception and company valuation became increasingly important as these companies approached Series C funding.

Putting It All Together: The Unicorn Roadmap

Reaching unicorn status isn’t just about having a great product. It requires orchestrating multiple factors simultaneously:

- Market timing: Enter when consumer demand is building but not yet saturated

- Competitive validation: Use competition to your advantage rather than seeing it as a threat

- Brand identity: Develop a distinctive voice that resonates emotionally with consumers

- Financial infrastructure: Build systems that can scale with your growth, as our growth model illustrates

What stands out after analyzing companies like OLIPOP, poppi, and Liquid Death is their remarkably similar financial evolution paths. Despite different product categories and brand approaches, these companies built financial infrastructure at nearly identical development stages — transitioning from cash to accrual accounting at similar points, implementing trade spending systems as they scaled, and building finance teams at predictable milestones. This financial discipline provided the foundation that enabled their creative branding strategies to flourish.

These patterns represent actual implementation rather than theoretical possibilities. For CPG founders with unicorn ambitions, the message is clear: Success isn’t random. It follows a pattern that can be studied, understood, and replicated. The billion-dollar blueprint is here. The question is: Are you ready to follow it?

Propeller works alongside founders, CFOs, and operators to help build real enterprise value. Ready to discuss how these principles apply to your CPG business? Let’s have a chat.