How to Create a Blockbuster Pitch Deck

Jeff Gustafson

CFO

If your startup is seeking to raise funds, you need a rockstar pitch deck. A compelling deck is an essential tool not only for helping you secure the right investors, but also for helping you land those meetings in the first place. Your pitch deck gives potential investors a peek into your business, including your story, vision, market opportunity, financial forecast, and growth potential, all packaged in a thoughtfully organized, attention-grabbing, and digestible format.

Since 2008, Propeller has helped a wide range of startups successfully navigate fundraising. That means we know a thing or two about creating a polished pitch deck. In this article, we’ll share:

Do You Need a Pitch Deck?

In short, yes. If your startup is looking to raise money, you will need to go through the exercise of creating a pitch deck to share with potential investors that gives them a high-level overview of your business. Your pitch deck is a key opportunity to make a strong first impression on an investor, so you need to ensure that it sparks enough interest to lead to a call or meeting.

Creating a pitch deck can also be incredibly beneficial for you, as it requires you to understand your business in a new way and think critically about how you want to position it. It compels you to see your business through investors’ eyes. It also shows investors that you’ve done a deep-dive into your business and are serious about sustainable growth and long-term success.

With all that said, when it comes time to present, don’t think of your investor deck as a crutch you’ll get to lean on throughout your meetings. Investors generally won’t want a page-by-page walk-through of your deck. Instead, they’ll want a back-and-forth conversation that answers their questions while helping them to more clearly understand your business as an investment opportunity. So, while you can refer back to certain pages, you should be prepared to use the meeting time to elaborate beyond your presentation to provide a broader and deeper perspective.

9 Things Your Startup Pitch Deck Should Include

What are the essential elements of a winning investor pitch deck, and what purposes do they serve? Below is Propeller’s formula for a blockbuster startup pitch deck that stands out from the crowd.

1. Investment Rationale

We generally recommend that your investment rationale — also known as “reasons to believe” — should go first in your deck, as you want to grab investors’ attention immediately. This page helps investors decide if they want to keep reading, so make sure it’s compelling! Ask yourself: If you had to distill your business into one page that explains why someone should invest, what would it say?

The investment rationale page should also serve to summarize the pitch deck’s contents, doubling as an informal table of contents. As a rule of thumb, the rest of your presentation should follow how your investment rationale is laid out. For example, if the page includes five or six bullets, the rest of the deck should follow that general flow of information and elaborate on each point sequentially.

2. Story, Vision, and Mission

Sharing your story, vision, and mission is a critical component of your pitch deck, as it helps you to form a connection with your audience. This page is your opportunity to engage investors who share your beliefs and mission and want to be a part of your journey. Incorporate messaging that speaks directly to problems that investors will understand and be interested in solving.

3. Market Opportunity and Traction

Investors immediately want to understand, “Can this be a billion-dollar business or just a ten-million-dollar business?” Clearly defining the market opportunity or category you are playing in helps to contextualize how large or growing that market is. In today’s uncertain economic climate, you need to show investors that you’re operating in a promising market that has potential for sustainable growth. This is also your opportunity to highlight the traction you’ve achieved, offering metrics, customer/partner feedback, rankings, press coverage, or other evidence that show how far you’ve come.

4. Problem and Solution

Successful business propositions involve creating products or services that identify and solve a problem worth solving. In other words, they provide a solution people want — rather than a solution nobody cares about. Your “Problem and Solution” slide doubles as an attention-getting company description that explains what your startup does. But instead of focusing on “what” you do, this slide tells the story of “why” you do it. Use this slide to create a vivid picture of the problem and solution your product addresses, including:

- What are the pain points that your product or service solves?

- How do you provide a better solution for this problem? What are your unique value propositions and competitive differentiators?

- Why will customers prefer your solution? Can you offer examples of real customer feedback that prove this out?

5. Competitive Differentiation

To provide investors with a broader perspective on where your business stands in the market, consider including a competitor comparison in graphic form (e.g., matrix, X/Y axis). Use this slide to showcase not only who your competitors are, but how your company is genuinely different. What makes your offering unique and better? What “secret sauce” does your solution offer that competitors’ solutions can’t?

6. Company Information

This is the “meat” of your presentation, showcasing the most essential components of your business in a digestible way. Key details investors want to know include:

- What is your business model? How do you generate revenue?

- Is there a specific revenue source that holds the greatest potential?

- Who are your suppliers and customers? Be specific.

- Who is on your management team?

7. Historical Financials

If you have historical financials, be prepared to share them – and make sure they’ve been triple-checked for accuracy. Investors need to feel confident that you understand the numbers and the story they tell.

8. Financial Forecast and Market Potential

While no one expects you to predict the future, investors do expect you to be thoughtful in how you plan to grow your business so that they can better understand the size of the market opportunity. What is your product or service’s longer-term market potential? Include a reasonable and credible forecast to a point where your business is self-sustaining or steady-state. A three- to five-year projection is typical.

9. Growth Plans

How much money are you looking for? How will you spend the money? Do you have a product roadmap? Use this slide to clearly address what you plan to do with the money you raise (e.g., hiring, marketing, inventory, product development, operations) and what strategic initiatives or milestones you will accomplish within a given timeframe.

How to Make Your Pitch Deck Stand Out

Investors receive hundreds of pitch decks. They do not have time to read hundreds of pitch decks. How can you ensure that your pitch will stand out in investors’ eyes, getting you that all-important meeting? The following tips are critical to keep in mind. It’s also helpful to look at successful pitch decks from other startups to find strategies proven to work. Your deck should:

- Look professional. If you didn’t spend time polishing your deck, why would investors trust that you’ll deliver polish in other areas?

- Cover all relevant points. Investors want to feel they’re making informed decisions. Show them you understand what matters to them, and that you’re prepared to answer their questions.

- Be credible. Investors want — and deserve — the real story.

- Be digestible. Respect their time. Tell a compelling story in as few words/visuals as possible.

- Include helpful visuals. Graphics can often tell your story more efficiently and effectively than text. What investor would favor an arduous, text-heavy deck over a strong visual presentation?

- Be on brand. Ensuring that your pitch deck portrays a consistent brand identity shows investors that you understand how much brand matters in a crowded marketplace.

- Leave some things out. It really is okay to strategically leave some things out! You want to grab investors’ attention, whet their appetite, and leave them wanting to learn more.

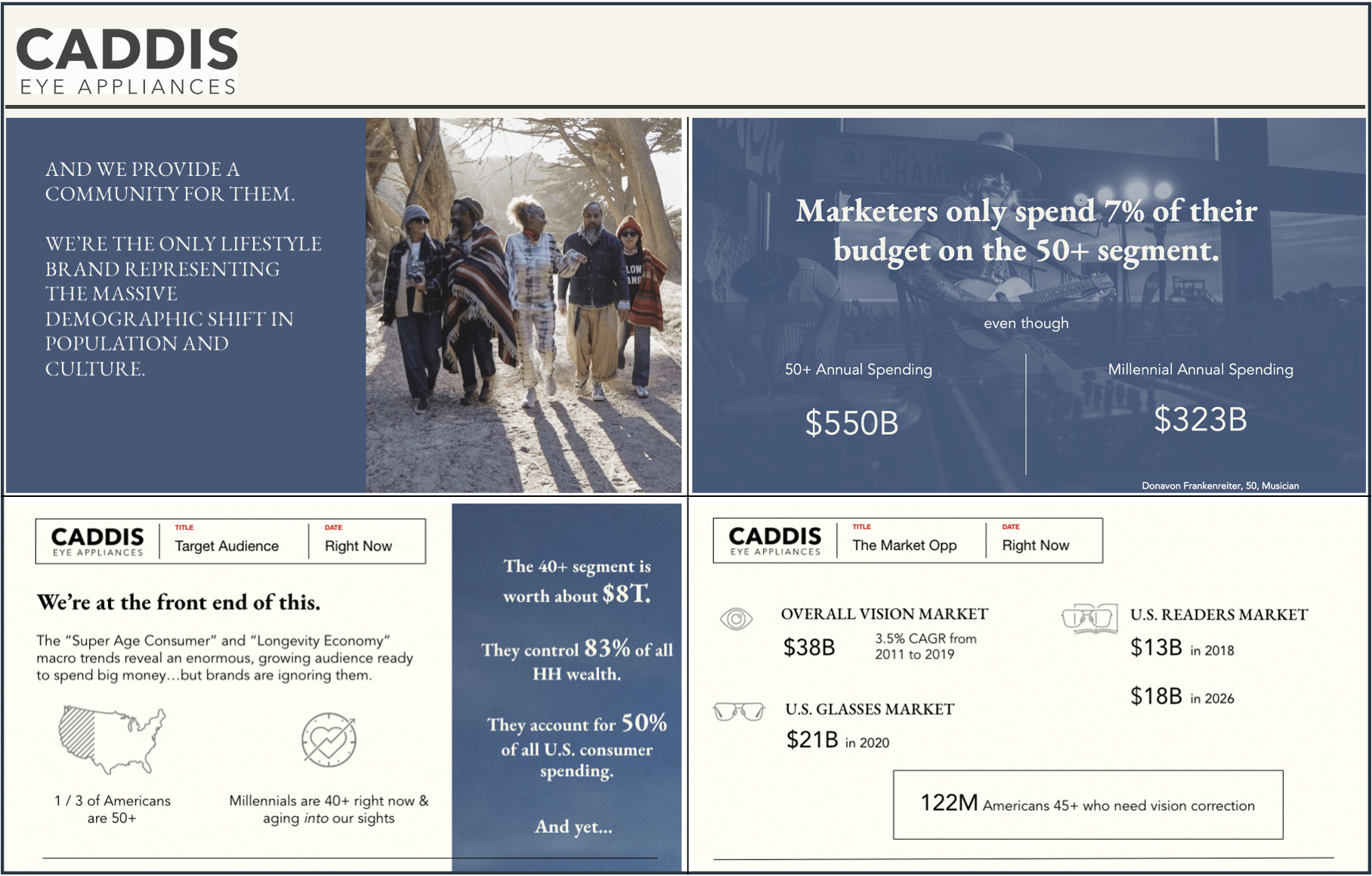

Pitch Deck Example #1: Caddis Eyewear

Propeller client, Caddis Eyewear’s pitch deck leads with their unmistakable brand image and voice, saying on page three that “Caddis makes readers that don’t suck for people who own their age.” Eye-catching visuals, blended with market statistics, help set the company apart as a brand that caters to an oft-overlooked eyewear market: people aged 40+.

How Propeller Helped to Develop the Narrative and Design

When the Propeller team started working with Caddis, we knew immediately that they had an incredible story, and that they had dynamically captured the essence of the brand in their photography. Their previous pitch decks and collateral, however, were dense with copy. We worked with Caddis to develop pithy and powerful headline messaging and infographic-driven slides that moved the audience from slide to slide in a natural and efficient way.

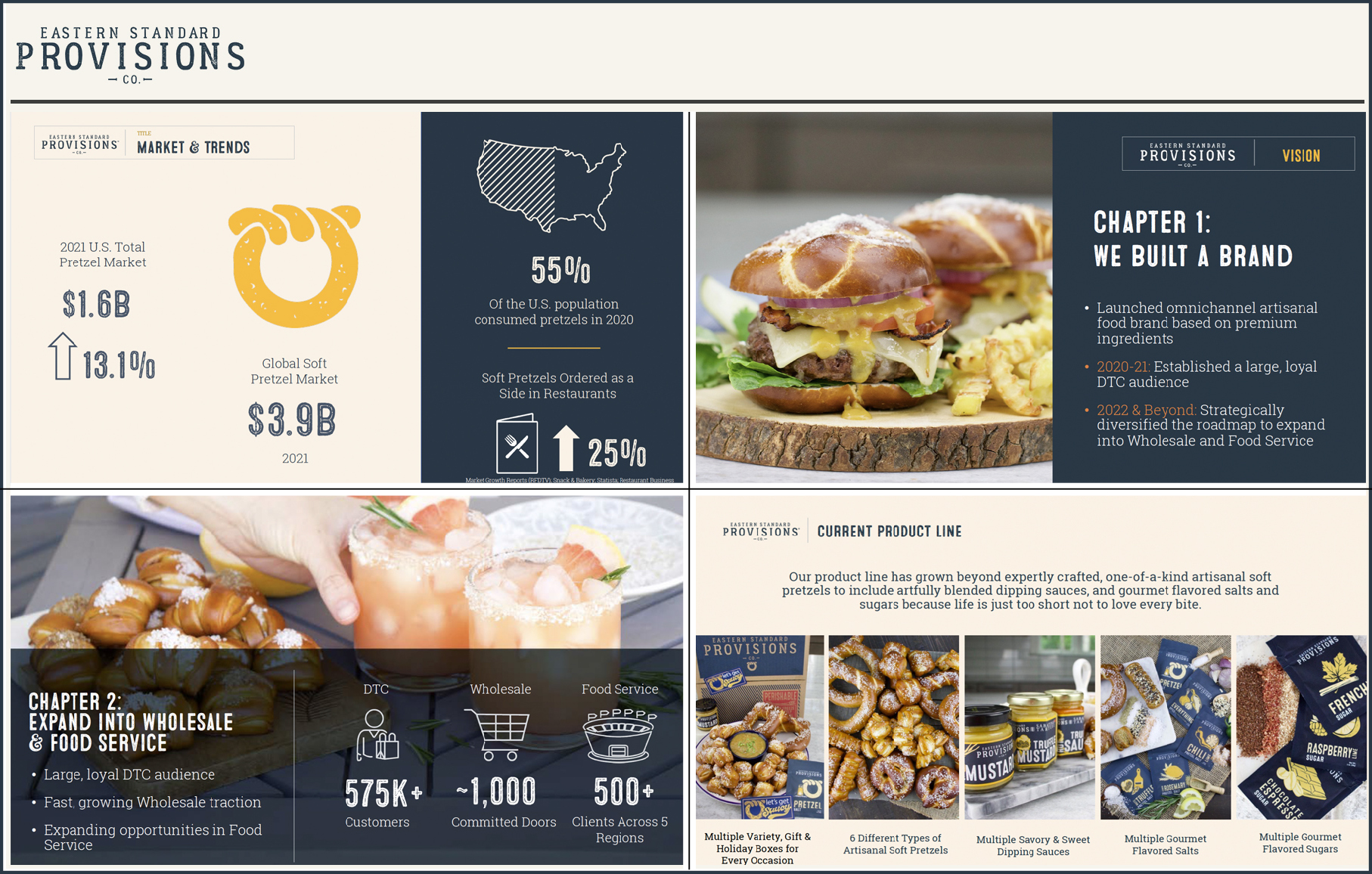

Pitch Deck Example #2: Eastern Standard Provisions Co.

Eastern Standard Provisions is “an artisanal food company that is fiercely passionate in elevating the snack food experience.” Their pitch deck presents clear narrative messaging and weaves together mouth-watering imagery from their product line with iconography and other infographic visuals to convey their business story.

How Propeller Helped to Develop the Narrative and Design

The startup needed to more effectively convey how the initial vision for the company was successfully playing out according to plan. Phase 1 of the business had positioned them to exponentially grow into Phase 2 and beyond. The Propeller team helped them to distill this core, top-line message in a succinct way.

The company’s brand had already developed its own library of rich, compelling photography. Propeller’s deck design used creative layouts to accentuate how those images were presented. While the photography was already engaging, we saw an opportunity to develop a new graphic style for them based around iconography and infographics to best communicate the most impressive aspects of their business strategy and success.

5 Pitch Deck Mistakes to Avoid

We’ve seen (and fixed!) it all — so why not let us save you some trouble? Here are five of the most common mistakes you should avoid when creating your pitch deck.

- Don’t make your deck too long. We recommend limiting pitch decks to 10-15 slides. Do not go longer than 20 slides.

- Don’t be wordy. Make your content scannable. Too much text causes the reader to slow down and read — and get impatient, and perhaps stop reading. Focus on using headline messaging, brief copy, and visuals that support readers in quickly picking up key highlights.

- Don’t leave out the investment rationale and company highlights. This is the most common mistake we see. Companies need to be able to distill the value of their business into one page so that potential investors are eager to keep reading.

- Don’t assume investors know your industry as well as you do. Avoid using abbreviations, acronyms, and other industry-specific terms. Proactively fill in any likely gaps in understanding.

- Ensure data is accurate and relevant. The KPIs and other financials you highlight should match the financial model that you’re sharing as part of their diligence.

Need Help Creating a Blockbuster Investor Pitch Deck?

In the current economic climate, a stellar pitch deck is more valuable than ever. Today’s investors are more risk-averse and cautious, intensifying their scrutiny on startups’ financials and market potential and raising the bar on expectations for growth and profitability. Against this backdrop, creating a pitch deck can feel daunting. If you’re looking for a seasoned partner to help you navigate fundraising efforts with confidence, Propeller can help. Whether you’re starting from scratch, need feedback on an existing deck, or anything in between, below are some specific ways we assist our clients with the pitch deck process:

- Financial component support. Need help unraveling your financial data for investors? As finance and accounting subject matter experts, we can help build your business model, including sales projections and key metrics.

- Pitch deck narrative development and creative design. We help our clients refine complex concepts into digestible formats and build messaging that resonates. The Propeller team includes not only fundraising experts but also content creators, storytellers, and graphic designers with journalism backgrounds to lead the deck-creation process.

- Review, reposition, and bolster existing decks. Does your current deck need some love? We can help overhaul your current deck’s narrative and design to make it more appealing and impactful for your target audience.

- Transaction Advisory support. At Propeller, we work with entrepreneurs through fundraising and M&A processes. We can introduce you to investors, assist with valuation analysis, negotiate term sheets, and more.

Are you an early-stage, high-growth company that’s looking for support with fundraising? Since 2008, Propeller has provided the financial expertise, consulting, and guidance businesses like yours require to navigate the challenges of entrepreneurship and business growth. Reach out to us today for a free consultation.